How to make sense of Donald Trump’s bizarre tariff rates

How to make sense of Donald Trump’s bizarre tariff rates

Our guide to a fiendishly complicated calculation

ON AUGUST 11TH an unpredictable president did a predictable thing: Donald Trump extended America’s tariff truce with China for at least another 90 days. The decision followed a frenetic spell of dealmaking and tariff-setting that has changed the terms of entry to the American market for dozens of other trade partners, from Canada to Congo. America has struck deals with the European Union, Japan, Britain, South Korea and Vietnam among others. It has announced punitive duties on Brazil, Canada and India, and set surprisingly harsh terms for Switzerland. It has also had to undo some of what it has done. In recent days Mr Trump has said on social media that gold will not, in fact, face tariffs. Japan’s government has also said its exporters will be compensated for new American duties that were wrongly stacked on earlier levies.

As the dust begins to settle, it is a good time to take stock of the tariff wall Mr Trump has built. Which countries have the easiest and toughest access to the world’s biggest market?

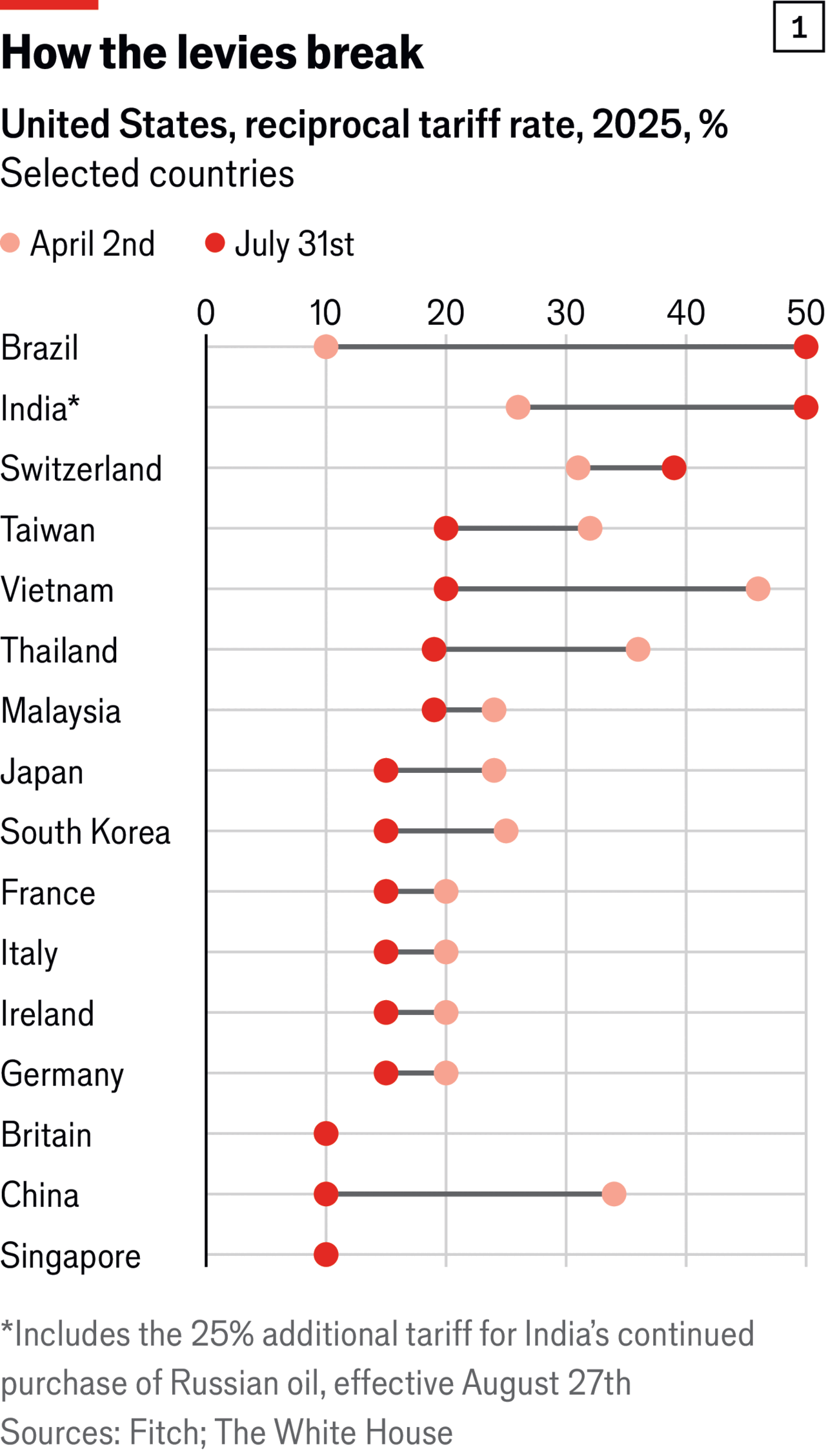

America’s tariff menu has over 17,000 lines, making it difficult to summarise. It distinguishes between horses and asses, fine wool and coarse, grinding machines and kneading machines, small cars (with a cylinder capacity of 1,500cc), even smaller cars (1,000cc) and bigger ones. Some of Mr Trump’s tariffs are sweeping, such as the “fentanyl” duties he has imposed on Canada, Mexico and China because of their role in the illegal opioid trade. Other levies are more targeted, such as his “sectoral” tariffs on car parts and metals. Mr Trump’s “reciprocal” tariffs, first announced on “Liberation Day” on April 2nd and revised on July 31st, are somewhere in between (see chart 1). They exempt several important categories of goods, such as smartphones. But they still touch more than half of the goods America bought from abroad last year.

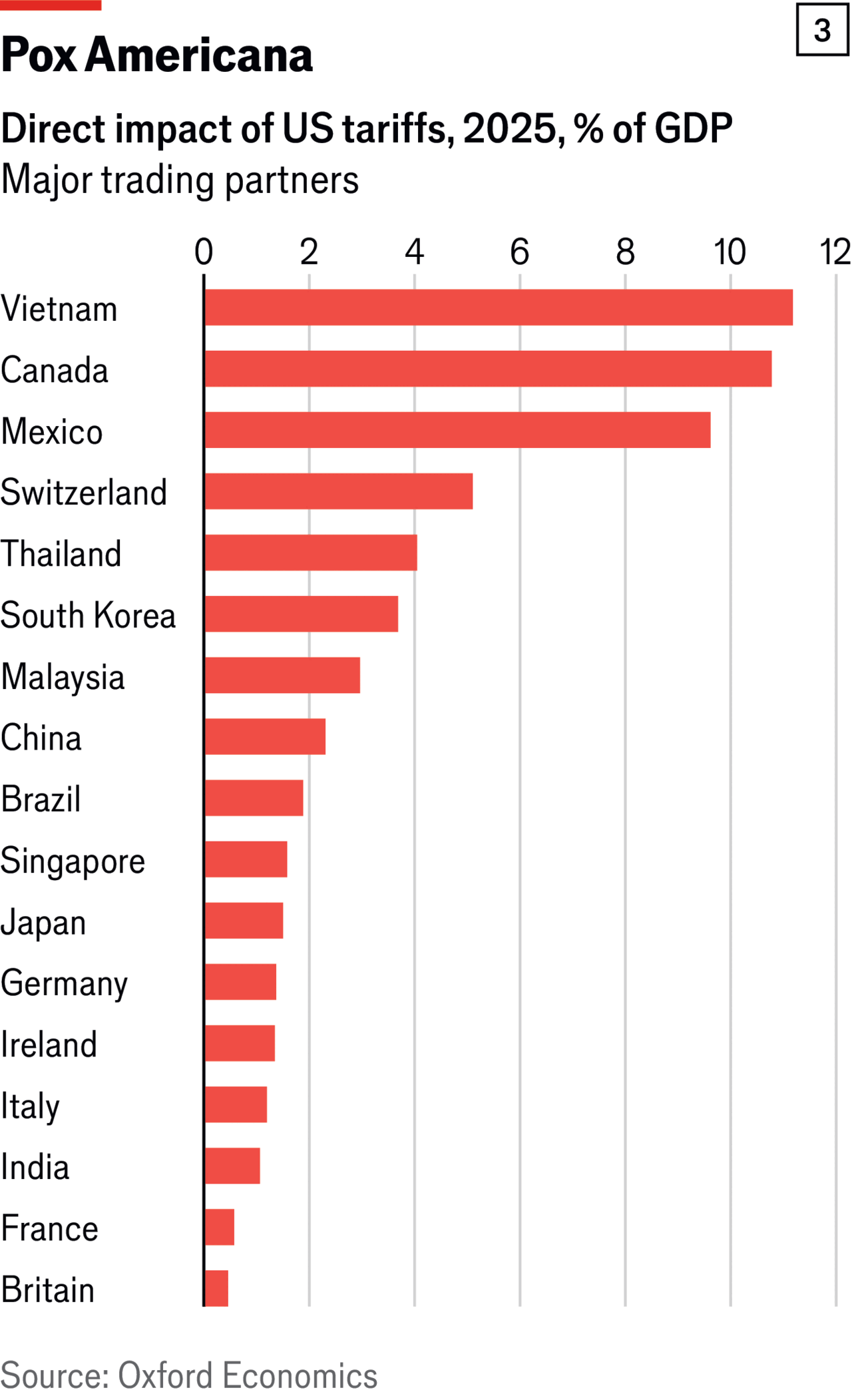

One way to sum it all up is to take a simple average across all tariffs. But that would give equal weight to every product, whatever its prominence in international trade. An alternative approach is to compare the duties America now collects with the amount it imports. If customs collects $10bn in duties on $100bn-worth of goods, then the tariff is, in effect, 10%.

But this approach has some perverse implications. As the tariff on a product rises, imports will shrink, reducing the tariff’s weight in the calculation. Indeed, if it is high enough, imports might grind to a halt. The exorbitant levy will then have no weight in the calculation at all.

For that reason, we have weighted America’s tariffs on its biggest trading partners according to its import patterns in 2024, before Mr Trump returned to office (see chart 2). The calculations do not yet take account of his recent social-media post on gold or the late tweak to Japan’s tariffs. But we have estimated the impact of the 50% tariff imposed on Brazi l to punish it for prosecuting Jair Bolsonaro, its former president. We have also included the extra 25% tariff that India will face from August 27th because of its purchases of Russian oil.

Our calculations show that China, despite the truce, still faces the highest average tariff among America’s big trading partners at almost 45%. If Mr Trump carries out his threat to punish India for buying Russian oil, the tariff it faces will jump from 21% to 36%, the second highest on our list. Although Brazil’s 50% headline rate looks even higher, it does not apply to over 40% of its exports to America. As a consequence, its average tariff, weighted by 2024 imports, is 29%—the third highest among America’s big trading partners. Mr Trump has, so to speak, built a tariff wall out of the BRICs. Malaysia (almost 13%) also fares better than many of its regional rivals, such as Thailand (almost 21%) and Vietnam (23%), largely because more of its goods fall into categories exempted from Mr Trump’s reciprocal tariffs. Ireland and Singapore also escape lightly, although that may change if Mr Trump introduces new levies on pharmaceuticals.

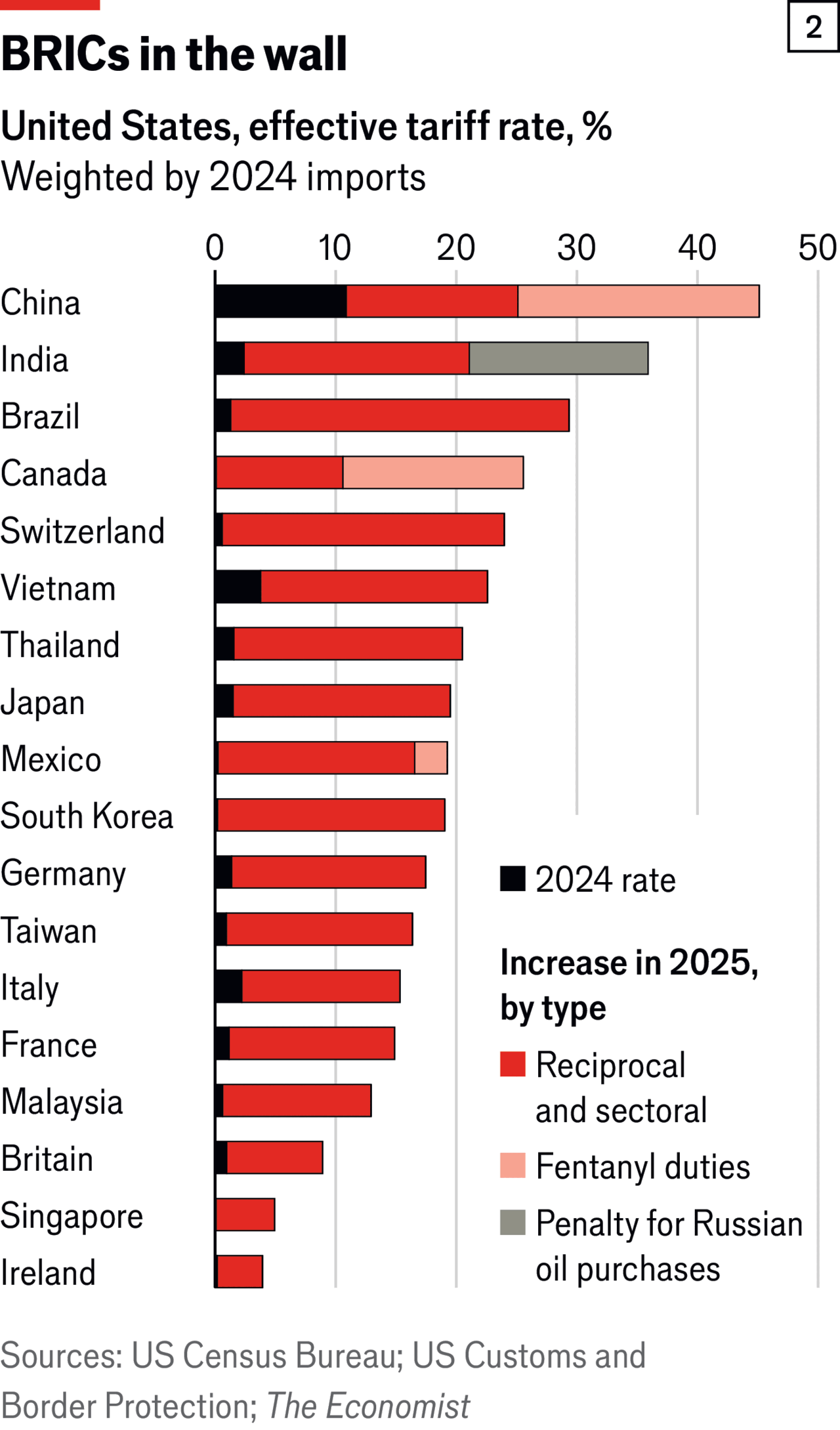

These tariff calculations reveal some winners and losers from Mr Trump’s new trade policy. But they are not by themselves a good guide to who will suffer the most. For some exporters, America is a captive market. They can safely add the tariffs to their prices without sacrificing many sales. Others sell more price-sensitive goods, which will lose a lot of their appeal if they become more expensive. Some countries also depend more heavily on sales to America than others. Exports to America are equivalent to almost 28% of Mexico’s GDP, for example, but less than 2% of France’s. To gauge an economy’s vulnerability to American protectionism, Oxford Economics, a consultancy, has combined these three factors: the average tariff a country faces, the price-sensitivity of their exports, and the importance of the American market to their economy (see chart 3). The result provides a rough guide to an economy’s direct exposure to American tariffs. Among America’s largest trading partners, Oxford Economics finds that Vietnam could suffer the biggest direct hit to GDP. Britain and France will suffer the least. Although China faces a high average tariff, the damage to its economy is relatively modest. After many years waging a trade war, direct exports to America have become a relatively small part of its economy.

“Tariffs are making our Country Strong and Rich,” Mr Trump crowed on social media on August 11th. They also, however, guarantee that America will become steadily less important to its trading partners. That is one predictable consequence of an unpredictable presidency.

.freemium-card h4{color:#fff; padding-bottom:20px;} .freemium-card .freemium-content .subcTxt{padding-bottom:16px; color:#fff;} .freemium-card .freemium-content{width: auto; max-width: inherit;} .freemium-card .freemium-content .subcTxt{max-width:inherit; font-size:18px; padding-top:0; line-height:24px} .freemium-card .btnSubc{margin} .freemium-card .btnSubc a{background:#000; color:#fff; min-width:auto; padding:5px 15px; border-radius:6px; font-size:16px; line-height:22px; font-weight:700;} .freemium-card{height:285px} @media (max-width: 767px) { .freemium-card h4{font-size:28px} .freemium-card .freemium-content{max-width:360px; padding: 20px;} .freemium-card{height:303px; background-position: 100% 0; } }